Kathy Orton reported in today’s Washington Post that, “House hunters might need to start adjusting their expectations as the days of ultra-low mortgage rates could finally be winding down.

“With homeownership hovering around a 50-year low, the American dream of owning a home seems like an unattainable goal to some, as prices are rising, supply is dwindling and mortgage rates have climbed to heights not seen in more than two years.

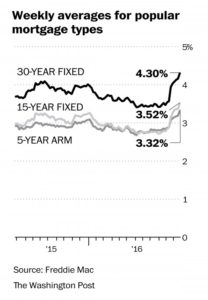

“According to the latest data released Thursday by Freddie Mac, the 30-year, fixed-rate average jumped to 4.3 percent with an average 0.5 point. (Points are fees paid to a lender equal to 1 percent of the loan amount.) It was 4.16 percent a week ago and 3.96 percent a year ago.”

Graph From The Washington Post.

Today’s article noted that, “A homebuyer who held off purchasing a $500,000 home in July when rates sank to 3.41 percent now will pay $255 more a month on a 30-year loan.”

The Post article added that, “The combination of higher rates and higher prices may present obstacles for potential homebuyers, as U.S. economic growth has been steady but slow. The housing market is very dependent on the jobs market. People are reluctant to make large purchases such as buying a home unless they have a steady income. Although unemployment is down, wage growth has been stubbornly lackluster. Average hourly earnings declined by 3 cents to $25.89 last month, offsetting the large gains in October.

“The rise in the 30-year fixed rate is also tempting borrowers to consider adjustable-rate mortgages again.”