A recent update at the farmdoc daily blog by Michael Langemeier (“Should Sweat Equity be Used to Compensate a Returning Family Member?“) noted that, “[S]weat equity may arise when an on-farm heir is paid less than their true opportunity cost to work for the business and/or the business has grown substantially due to the abilities and efforts of the on-farm heir. Let us look at these two items one at a time. Suppose a returning family member has the opportunity to work for a local retailer that with benefits would pay them $75,000 per year. The farm is currently not able to match this offer. Instead of a $75,000 salary with benefits, the farm is willing to pay the returning family member a salary and benefit package of $50,000 per year.”

“Sweat equity also occurs when the business has grown substantially, at least partially as a result of, the abilities and efforts of the returning family member. To motivate our discussion, let’s assume that the farm purchased and rented additional land when the family member returned to the farm. Owned land is a major asset of U.S. farms accounting for approximately 84 percent of total assets. The returns to land include operating income and appreciation. To capture appreciation the land would have to be sold. Obviously, this often not feasible or prudent. Sweat equity can be used to capture land value appreciation that occurs when land is purchased to accommodate the returning family member. If the older generations helped purchase the land, not all of the land value appreciation would accrue to the returning family member.”

Dr. Langemeier pointed to an example for analysis and indicated that, “In this example, Mom and Dad want to keep the farm in the family. The youngest of three children, Michael, came back to the farm in 1990. Unfortunately, if the farm business was divided into three equal pieces, it would not be of an adequate size to create a viable farm business for Dad, Mom, and Michael. When Michael came back to the family farm in 1990, the fair market value of the business (i.e., owner’s equity) was $420,000. At that time, Mom and Dad agreed that the contribution of each child up to 1990 was equal. Dividing the $420,000 by three results in a contribution of each child of $140,000. Today’s fair market value of the business is $1,680,000. If we divide by three, $560,000 would be left to each child. However, the contributions of the three children have not been equal since 1990. There were very few promises made to Michael when he returned to the farm. However, decisions were made because he came back (e.g., land was rented and purchased). Mom, Dad, and Michael know that his contribution to the family farm has resulted in Michael developing a sizable investment in ‘sweat equity‘ in the farm business.”

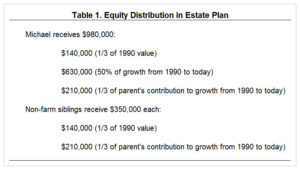

The farmdoc update noted that, “After careful consideration, Mom and Dad decided that they would equally divide the 1990 value of the farm business between the three children. They also decided that Michael was responsible for 50 percent of the farm growth since 1990 (value of business grew from $420,000 to $1,680,000 or $1,260,000). Table 1 outlines the resulting equity distribution in the estate plan. At this point, Mom and Dad want to establish procedures for how the equity would be split. The amounts presented will likely be changed to reflect future changes to the farm’s equity position. A couple caveats should be noted. First, it is often difficult to determine how much ‘sweat equity’ contributed to the increase in the value of the business. Second, the level of Michael’s annual compensation is an important consideration when valuing ‘sweat equity.’ If Michael was paid something close to his opportunity cost when he returned to the farm, the computations in table 1 would likely be different.”

Table 1, from the farmdoc daily blog, January 13, 2017.

Dr. Langemeier added that, “On profitable farms with an increasing owner’s equity over time, using sweat equity to recognize the contributions of a returning family member has a place. However, if a farm is not profitable or large enough to compensate someone returning to the farm, the use of sweat equity if extremely problematic.”