Bloomberg writer Mario Parker reported today that, “Deere & Co., the world’s largest manufacturer of farming machinery, raised its 2017 profit forecast and said there are signs the worst may be over in a market that’s suffered a sustained slump lasting years.

“Net income will be about $1.5 billion in the year through October, Deere said Friday in a statement, exceeding both its own previous forecast and the average estimate among analysts, both of which were $1.4 billion. It also sees net sales increasing by about 4 percent for the year, from 1 percent previously. The shares rose as much as 3.9 percent to a record high in pre-market trading in New York.

“‘We are seeing signs that after several years of steep declines key agricultural markets may be stabilizing,’ Chief Executive Officer Sam Allen said in the statement. ‘Deere continues to perform far better than in agricultural downturns of the past.'”

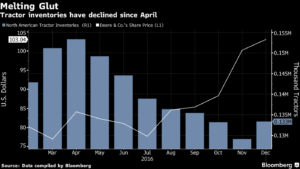

Graph from Bloomberg Business News.

Mr. Parker pointed out that, “There have been positive signs recently in the machinery market. North American tractor inventories through December, while at a record seasonally, have declined 13 percent since April, data compiled by Bloomberg show. Deere’s shares have rallied over the last several months, which may be one reason why Warren Buffett’s Berkshire Hathaway Inc., once Deere’s second-biggest shareholder, disclosed earlier this week that it sold its entire stake during the fourth quarter.”

Nonetheless, today’s article noted that, “Still, market conditions remain tough. The U.S. Department of Agriculture earlier this month forecast American farmer incomes will fall for a fourth year to their lowest since the financial crisis. That would be the longest streak of declines in 40 years.”