A recent article in Amber Waves (“Growing Organic Demand Provides High-Value Opportunities for Many Types of Producers,” USDA’s Economic Research Service (ERS)) indicated that, “Organic agriculture began developing in the first half of the 20th century as an alternative to conventional production systems that use synthetic chemical inputs. USDA set national organic standards in 2000, providing a single set of rules for U.S. organic farmers and handlers and replacing the patchwork of State and private standards that had emerged by the early 1990s.”

The article noted that, “While U.S. organic food sales still account for a relatively small share of total U.S. food sales, they have exhibited double-digit growth during most years since 2000 and the organic share has been growing rapidly. In 2015, the Organic Trade Association estimated U.S. organic retail sales at $43.3 billion. Along with natural food supermarkets, restaurants, and direct marketers, most major U.S. food retailers—including Costco, Walmart, and Target—have expanded their organic food offerings in recent years.

“Rapid expansion in consumer demand continues to provide opportunities for U.S. organic producers to enter high-value markets in the United States and other countries. Although the United States and the European Union (EU) are the two biggest markets for organic products, most countries have growing domestic markets.”

The ERS item explained that, “Organic products have shifted from being a lifestyle choice for a small segment of consumers to being consumed at least occasionally by many Americans. In 2014, Gallup included questions on organics in its annual food consumption survey for the first time and found that 45 percent of Americans actively tried to include organic foods in their diets.”

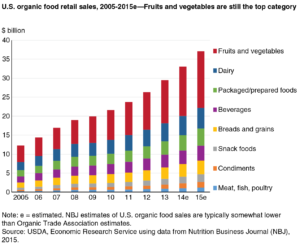

The Amber Waves article also pointed out that, “While fresh fruits and vegetables were still the top selling organic category, organic sales in all the other food categories also grew between 2005 and 2015. ”

Graph from Amber Waves, February 6, 2017 (USDA-ERS).

The article added that, “ERS analysis of U.S. organic sales data for five major retail food categories shows that the organic market share increased for most categories between 2009 and 2014.”

Graph from Amber Waves, February 6, 2017 (USDA-ERS).

Nonetheless, the article stated that, “Despite potentially higher per-acre returns, the adoption of organic production systems for corn and soybeans has been slow. This is due to factors such as achieving effective weed control and the processes involved with organic transition and certification. Organic corn and soybean production was, on average, conducted on farms with less total acreage and less field crop acreage than conventional farms.”

More broadly, ERS also pointed out that, “U.S. consumer demand for organic food has outpaced domestic production since the national standards were set in 2000. Public and private sector initiatives could further boost demand. In 2010, USDA set its first priority goal for organic agriculture: expanding the number of U.S. certified organic operations by 25 percent over a 5-year period. To facilitate transition to organic production, USDA developed new provisions in risk management, conservation, research, and other farm programs to widen access to these programs for organic and transitioning producers. USDA also expanded U.S. agricultural trade efforts to include bilateral negotiations to facilitate organic trade. In addition, Congress boosted funding for a number of organic programs in the 2014 Farm Act to assist producers with organic certification costs, expand organic research, and improve technical assistance and crop insurance.”