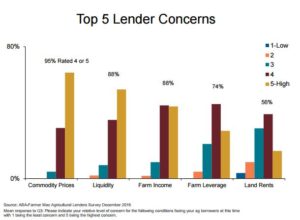

A news release on Monday from the American Bankers Association (ABA) indicated that, “Nearly 90 percent of agricultural lenders have seen an overall decline in farm profitability in the last 12 months, according to a joint survey by the American Bankers Association and the Federal Agricultural Mortgage Corporation. The survey of more than 350 agricultural lenders representing institutions of all sizes across the country revealed that when it comes to their producer customers, lenders are most concerned about commodity prices, liquidity and farm income.”

“Winter 2016/2017 Agricultural Lender Survey Results.” American Bankers Association and the Federal Agricultural Mortgage Corporation (May 1, 2017).

The ABA update noted that, “Ninety-five percent of lenders indicated commodity prices — particularly grains, beef cattle and dairy — are a top concern. While concerns about commodity prices varied by region, overall, lenders are most concerned about grains (80 percent rated it a four or five on a scale of one to five) followed by beef cattle (63 percent), dairy (55 percent), swine (40 percent), poultry (21 percent), vegetables (20 percent), and fruits and nuts (17 percent).