In a report last month from CoBank (“Grain Elevator Outlook 2018/2019“), Will Secor indicated that, “Storage capacity will be pushed to the limit in some regions this year. 2018 is the fifth consecutive year that U.S. corn and soybean yields are above trend for the nation.

“Grain Elevator Outlook 2018/2019,” by Will Secor. CoBank Report (November 2018).

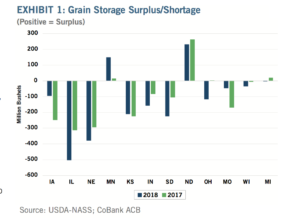

“However, some regional storage surpluses have started to emerge for two reasons. First, a slow Midwestern harvest has increased corn yield losses to around 10-15 percent in some areas. Second, 2018 acreage shifted significantly in favor of soybeans. As a result, some elevators, especially in the Western Corn Belt are finding it difficult to gain ownership of harvest bushels.

“Slow soybean exports will force many elevators to store more soybeans longer. This will increase storage costs for many elevators due to the higher price of soybeans relative to corn and wheat.”

Mr. Secor noted that, “Future interest rate hikes will be an important factor for elevators holding crops this year. The Fed is expected to increase the federal funds rate in December and two times in 2019. This potential 75 basis point increase in interest rates would increase the cost of carry by around 15 percent.

“As interest rates rise, the cost of carry increases. Futures market carry will need to widen to accommodate this going forward. Additionally, elevators will face higher storage costs than usual as they will likely be carrying more soybeans.”

The CoBank report also pointed out that, “The keys to watch in the year ahead will be for any resolution to the trade dispute as well as the South American crop. If the trade dispute is resolved, China will buy U.S. soybeans again, but they are unlikely to return to the same levels as before. New relationships were built during this disruption with non-U.S. suppliers. Chinese buyers will not switch back right away and may not return to previous levels for several years.”