Wall Street Journal writers Corrie Driebusch, Maureen Farrell and Dave Michaels reported earlier this week that, “The government shutdown is threatening to spoil what was poised to be a banner year for IPOs.

“The partial closure of the Securities and Exchange Commission is forcing companies that were seeking to list shares in January to push back their plans, according to bankers and lawyers. They include biotechnology firms Gossamer Bio Inc., Alector Inc. and Blackstone Group LP’s Alight Solutions LLC.

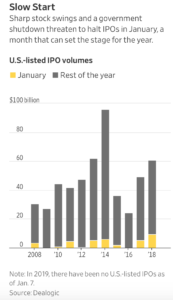

“It now looks likely that no major company will tap the U.S. IPO market this month. Since 1995, there have been just three years that had a new-issue drought in January, according to Dealogic data. That happened as a result of choppy markets in 2003, 2009 and 2016, which went on to be some of the weakest years for initial public offerings on record, the data show.”

“U.S. Government Shutdown Freezes IPO Market, Imperiling Expectations for 2019,” by Corrie Driebusch, Maureen Farrell and Dave Michaels. The Wall Street Journal (January 9, 2018).

The Journal writers pointed out that, “As part of the shutdown, currently the second-longest on record, the SEC has furloughed thousands of employees and stopped reviewing and approving all new and pending corporate registration statements, including proposed IPO filings, according to the agency’s shutdown plan and other notices on its website. Dozens of SEC accountants and lawyers who review IPO paperwork are prohibited from reading email or calling deal lawyers seeking to discuss complex disclosure questions.

“By contrast, past shutdowns hardly affected the SEC; in 1995, 1996 and 2013, the agency was able to draw on surplus cash to remain open while other government offices closed. The SEC this year didn’t have enough funds available to ride out the entire shutdown.”

This week’s Journal article also explained that, “The halt in the work at the SEC is threatening a resurgence in the IPO business in the past couple of years as more private companies warm up to the possibility of public ownership. With some of the largest startups, including Uber Technologies Inc., Lyft Inc. and Pinterest Inc., planning share sales, bankers and lawyers have said 2019 could set a record for IPOs in terms of dollars raised.”