Wall Street Journal writer Laura Kusisto reported recently that, “The exurbs, the engine of the American housing market, are back.

“A decade ago, the sight of new homes under construction in Maricopa, an enclave of tidy cul-de-sacs 35 miles from downtown Phoenix, was almost unimaginable. Four in five homeowners were underwater, with their outstanding mortgages worth more than their properties, according to housing data tracker Zillow. Neighbors felt compelled to cut the hedges and clean up garbage at empty houses.

“Last year, Maricopa issued permits for nearly 1,000 new homes. In the depths of the housing downturn, in 2010, it issued just 110.”

The Journal article explained that, “Across the country, the housing market overall has slowed. But in the regions just beyond the affluent suburbs, new home building and sales are showing signs of life. Rising mortgage rates and home prices, especially in urban centers, are once again motivating buyers to drive until they can afford a home, including in Dallas, Las Vegas, Atlanta and the San Francisco Bay Area. Low gas prices help as well.

“Analysis by the National Association of Home Builders, set to be released later this year, shows that single-family construction rose nearly 7% in exurban areas in 2018 compared with a year earlier. Home building overall rose less than 3% in the same period. The group defines exurbs as outlying counties in major metropolitan areas.

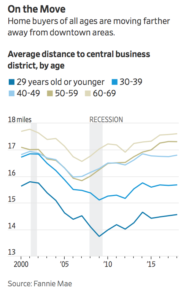

“These buyers, often millennials and retirees, purchased homes on average more than 16 miles from central business districts in 2018, the greatest distance since 2004, according to Fannie Mae loan data.”

“A Decade After the Housing Bust, the Exurbs Are Back,” by Laura Kusisto. The Wall Street Journal (March 26, 2019).

Ms. Kusisto noted that, “In recent years, millennials have driven demand for rental apartments in downtown areas. Some in the industry thought this could be a permanent phenomenon. And yet, as they begin to marry and have children, millennials are proving like generations before them that they are willing to move to more affordable outlying areas.”

The Journal article added that, “Compared with the last boom, builders and lenders say new communities aren’t reliant on subprime mortgages and speculative investment. Buyers are more often using loans backed by the Federal Housing Administration that require only a 3.5% down payment and a minimum credit score of 580, or Department of Veterans Affairs or U.S. Department of Agriculture loans that require no down payment.”