Last week, Wall Street Journal writer Ben Eisen reported that, “Some low- and middle-income home buyers are having a hard time getting mortgages for an unexpected reason: The loans they’re applying for are too small.

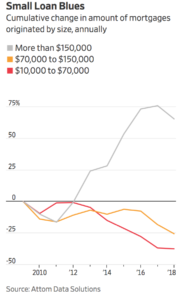

“Lenders extended about 106,000 mortgages with balances between $10,000 and $70,000 in the U.S. last year, worth $5.1 billion. That is down 38% from almost 171,000 in 2009, according to figures compiled by Attom Data Solutions, a real-estate data firm. The drop-off at the bottom end of the market has been far swifter than at the top. Origination was down a more modest 26% for mortgages between $70,000 and $150,000, and it rose 65% for mortgages above that range.”

“Small Mortgages Are Getting Harder to Come By,” by Ben Eisen. The Wall Street Journal (May 9, 2019).

The Journal article noted that, “Only about a quarter of homes that sold for less than $70,000 were financed with a mortgage, while almost 80% of sales between $70,000 and $150,000 had one, according to an Urban Institute analysis last year. Low-end borrowers had their applications denied at a higher rate than those taking out bigger mortgages even when comparing borrowers with similar credit quality, according to the think tank.

“Housing experts say small mortgages have become rarer because lenders have trouble making profits on smaller loans. Lenders typically have a fixed cost to extend a mortgage, and the smaller the loan, the smaller the profits.”

Mr. Eisen added that, “The dearth of smaller mortgages is becoming an impediment to home buying in regions where prices are otherwise affordable, especially in Midwestern and Southern cities like Chicago, St. Louis, Youngstown, Ohio, and El Paso, Texas, according to local housing advocates and attorneys.”