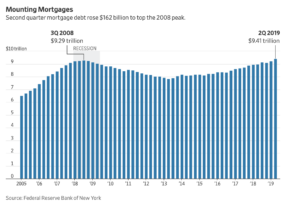

Harriet Torry reported in today’s Wall Street Journal that, “U.S. mortgage debt reached a record in the second quarter, exceeding its 2008 peak as the financial crisis unfolded.

“Mortgage balances rose by $162 billion in the second quarter to $9.406 trillion, surpassing the high of $9.294 trillion in the third quarter of 2008, the Federal Reserve Bank of New York said Tuesday.

“Mortgages are the largest component of household debt. Mortgage originations, which include refinancings, increased by $130 billion to $474 billion in the second quarter. The figures are nominal, meaning they aren’t adjusted for inflation.”

“U.S. Mortgage Debt Hits Record, Eclipsing 2008 Peak,” by Harriet Torry. The Wall Street Journal (August 14, 2019).

The Journal article added that, “The milestone for mortgage debt has been long in the making. Americans’ mortgage debt dropped by about 15% from the 2008 peak to the trough in the second quarter of 2013 and has climbed slowly since then.

“Total household debt has been on the rise since mid-2013. It rose by 1.4% from the first quarter to $13.86 trillion, the 20th consecutive quarter of increase.”

Ms. Torry added that, “Still, the household debt picture is much different in 2019 than it was 11 years ago, since lending standards are tighter and less debt is delinquent today.”