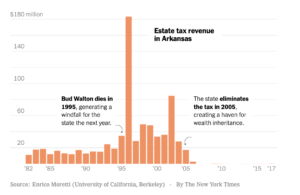

Eduardo Porter reported in today’s New York Times that, “Arkansas reaped a windfall when a Walmart founder, James L. Walton, known as Bud, died in 1995 with a fortune estimated by Forbes at $1.65 billion in today’s money. The next year, state estate tax receipts jumped 425 percent, to about $183 million in current dollars.

“In an age when bigger fortunes are being made, the states’ prize is getting richer. Research by Enrico Moretti of the University of California, Berkeley, and Daniel J. Wilson of the Federal Reserve Bank of San Francisco estimates that if Jeff Bezos of Amazon died today at his home in the Seattle suburbs, the state tax bill on his estate, estimated by Forbes at more than $100 billion, would add up to almost $12 billion. Washington State’s entire budget for two years is $52 billion.

“There’s a hitch to state estate taxes: The rich can move to avoid their reach. That makes counting on the revenues a bit of a crapshoot. If an aging Mr. Bezos moved before he died, establishing his residence in California, his fortune would produce no estate tax revenue.”

“Estate Taxes Are Easy to Flee, but They Still Help States,” by Eduardo Porter. The New York Times (October 21, 2019).

The article noted that, “And yet the payoff from estate taxes can be so big that it’s worthwhile for states to impose them anyway.”

Mr. Porter explained that, “The older the wealthy get, the less likely they are to continue to live in states that charge estate taxes. Mr. Moretti and Mr. Wilson estimate that from 2001 to 2017, a 40-year-old billionaire on the Forbes list had a 22 percent chance of living in a state with an estate tax. By age 70, the odds were only 14 percent. By age 90, they had fallen to only 9 percent.

“But over the long run, Mr. Moretti and Mr. Wilson conclude, the state estate tax can be a useful tool. From 1982 to 2017, the death of the average Forbes billionaire generated $165 million in revenue in states with estate taxes. Lots of billionaires moved to avoid them. But estate taxes raised more money for states that had them than they lost in income-tax revenue when billionaires left.”

The New York Times article added that, “Currently, federal estate and gift taxes apply beyond a threshold of $11.4 million per person. They are levied at a top rate of 40 percent and raised $23 billion in 2018.

“Unlike the issues with state taxes, the rich can’t move out of the country to avoid federal estate taxes because United States citizens are liable for the tax no matter where they live.”