Eliot Brown reported earlier this week at The Wall Street Journal Online that, “When Tony Xu, chief executive of food-delivery company DoorDash Inc., began raising funding late last year, he told investors he expected to raise up to $250 million to support his growing, five-year-old business.

“He misjudged the market. SoftBank Group Corp. and Singapore sovereign-wealth fund GIC, both competing to invest heavily in startups, pushed up the size of the fundraising round to $535 million, people familiar with the deal say.

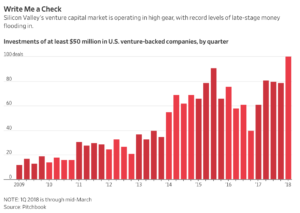

“The Silicon Valley money machine is once again in high gear, thanks largely to SoftBank. The conglomerate is injecting billions of dollars into tech, in turn causing deep-pocketed global investors—and some U.S. venture firms—to arm up in response. A record level of late-stage money is flooding in, threatening to keep some startups out of the public markets even longer while heightening concerns that the sector is overvalued.”

“SoftBank’s Billions Spur Global Race to Pour Money Into Startups,” by Eliot Brown. The Wall Street Journal Online (April 15, 2018).

Mr. Brown indicated that, “In recent months, hotly contested companies like ride-hailing service Lyft Inc. and dog-walking app Wag Labs Inc. have received hundreds of millions of dollars more than they sought. Bidding wars are re-emerging, and some once-staid foreign investors are expanding U.S. offices and ditching their ties and suits to court talented entrepreneurs.

“‘The top companies have as much heat around them as ever and continue to get bid up,’ said John Locke, who runs late-stage investing for venture-capital firm Accel Partners.”

The Journal article added that, “The activity marks a shift from two years ago, when the Silicon Valley startup market chilled amid the realization that private valuations had often been higher than what companies received from public markets, leading to a number of lackluster tech IPOs. Venture capitalists began demanding companies focus on revenue and profit rather than user growth, and investment fell, particularly from mutual funds.

“Then came SoftBank’s $92 billion tech-focused Vision Fund, launched last spring. Backed largely by sovereign-wealth funds in Saudi Arabia and Abu Dhabi, the fund in the past year has invested more than $36 billion globally—more than the $33 billion the entire U.S. venture-capital sector raised last year, according to PitchBook.”