This week, Wall Street Journal writer Maureen Farrell reported that, “The IPO market has gone from hot to not.

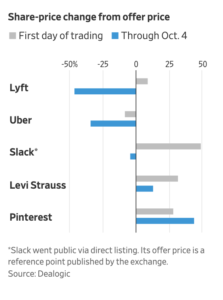

“Shares of newly public companies, earlier this year one of the hottest investments on Wall Street, are now in a slump after investors soured on unprofitable startups from Uber Technologies Inc. to WeWork.

“Shares of technology startups and other companies that went public in the U.S. this year are trading roughly 5% above, on average, their prices at their initial public offerings, well short of the 18% gain in the S&P 500 index, according to Dealogic data. That is a reversal from earlier in the year, when IPO shares were big outperformers.”

The Journal article explained that, “IPO-stock performance is the worst it has been since at least 1995, according to a recent research note from Goldman Sachs, whose analysts measured it relative to a broad stock-market index.”

“Fear Overtakes Greed in IPO Market After WeWork Debacle,” by Maureen Farrell. The Wall Street Journal (October 6, 2019).

Ms. Farrell added that, “Bankers and lawyers now say it is unlikely that 2019 will be the record year that many had envisioned. So far this year, 158 companies have raised $53.1 billion on U.S. exchanges, according to Dealogic, the fourth-busiest year on record behind 1999, 2000 and 2014. Should activity taper off as expected, 2019 could fall behind other years too.”